Red Lobster, beloved for its seafood offerings, is navigating stormy seas as it faces the potential closure of more than 100 locations due to crippling leasing issues. The recent Chapter 11 bankruptcy filing on May 19 underscored the company’s financial struggles, exacerbated by soaring rent costs and poor lease agreements orchestrated by previous private-equity owners. With over $200 million paid annually in rents, a significant fraction of its revenue, the chain’s ability to renegotiate these leases will be crucial. The fate of iconic outlets, such as the long-standing Times Square location, hangs in the balance as the company feverishly works to stave off further closures. Have you ever wondered how a beloved restaurant chain can find itself on the brink of closure? It’s a fascinating and sobering topic, and today, we’ll delve into the challenges faced by Red Lobster, one of the most well-known seafood restaurant chains in the world. Recently, Red Lobster has been in the news for all the wrong reasons, facing the potential closure of more than 100 locations due to leasing issues.

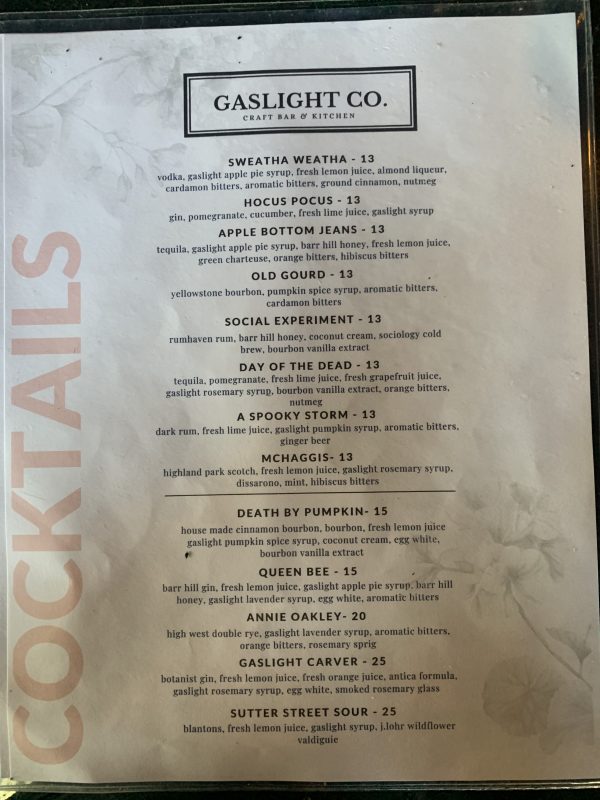

Red Lobster Faces More Than 100 Possible Closures Due To Leasing Issues

Get an Official Zagat Restaurant Guide

Financial Woes and Bankruptcy

Red Lobster’s current situation is dire, to say the least. The company’s financial troubles culminated in the filing for Chapter 11 bankruptcy on May 19, 2024. Before this, the chain had already shuttered dozens of its locations across the United States. If the leasing issues are not resolved, even more locations could face closure.

The Core Issue: Leasing Problems

The heart of Red Lobster’s predicament lies in its leasing agreements. According to recent bankruptcy filings referenced by Restaurant Business Online, Red Lobster has rejected over 230 leases for restaurant locations that have become financial burdens due to exorbitant rent prices. Nearly 100 of these restaurants have already closed, but another 130 are potentially on the chopping block, including the high-profile Times Square location in New York City.

The problem is primarily that a substantial portion of the leases are priced above market rates. This isn’t just a little bit higher; it’s more than double in some cases. In total, Red Lobster spends around $200 million annually on rent, which corresponds to about 10% of its revenues. This pricing discrepancy is at the core of the chain’s financial struggles.

Get an Official Zagat Restaurant Guide

The Cost of High Rents

Let’s break down what these high rents mean for the company.

| Rent Consideration | Annual Cost | Percentage of Revenue |

|---|---|---|

| Pre-Bankruptcy Rent | Roughly $100 million | ~5% |

| Current Rent | $200 million | 10% |

As you can see, the rent has essentially doubled, putting immense pressure on the chain’s bottom line. Higher operational costs due to inflated rents significantly impact the profitability of each location, making some restaurants completely unviable.

The Role of Private-Equity Firms

You might wonder, how did Red Lobster get into this mess in the first place? Many experts point to the role of private-equity ownership, specifically Golden Gate Capital, which acquired Red Lobster in 2014 and held a stake until 2020. During this period, the firm engaged in a common practice known as asset-stripping, whereby they sold off company assets like real estate for immediate profit but detrimental long-term effects.

What is Asset-Stripping?

Asset-stripping involves selling company properties to outside investors and then leasing them back. In the case of Red Lobster, this meant selling the land on which their restaurants were built and leasing it back at often inflated rates. This practice left Red Lobster at the mercy of new landlords and their rent increases, contributing significantly to the current leasing problems.

Industry-Wide Challenges

Red Lobster’s leasing issues are compounded by various industry-wide challenges:

- Inflation: Rising costs of goods and services make it expensive to operate.

- Rising Food Costs: Seafood prices have been escalating, further straining profits.

- Covid-19 Pandemic Aftereffects: The pandemic changed the way people dine out and disrupted supply chains.

Specific Financial Missteps

To make matters worse, Red Lobster’s management faced criticism for certain financial decisions. For example, making “endless shrimp” a permanent menu option might have delighted some customers but was not beneficial financially. The dish’s popularity led to increased costs without equivalent revenue gain, exacerbating their fiscal problems.

Impact on Employees and Local Communities

The potential closures will significantly affect employees and the local communities where these restaurants operate. Each closure means lost jobs and diminished local economic activity, as Red Lobster is often a key player in these areas.

What’s Next for Red Lobster?

The path forward is fraught with uncertainty. To avoid further closures, Red Lobster must negotiate lower rent prices for the locations listed in their bankruptcy filings. This is easier said than done, as landlords are understandably reluctant to agree to lower rents.

Additionally, management must navigate a financial recovery strategy that mitigates the damage caused by these high leases and reassesses their overall business model.

Potential Solutions and Strategies

- Renegotiate Leases: Open discussions with landlords to find a mutually agreeable solution.

- Operational Efficiency: Explore ways to tighten operational costs to improve profit margins.

- Menu Adjustments: Reassess menu choices to ensure financial benefits align with customer satisfaction.

- Community Engagement: Strengthen community ties to build a loyal customer base, even amidst closures.

Outlook for the Future

The financial troubles facing Red Lobster highlight larger issues within the restaurant industry, where high operating costs, competitive markets, and financial missteps can drastically impact even the most established chains. However, the company’s ability to navigate these challenges could offer a blueprint for other restaurants grappling with similar issues.

Efforts to resolve the leasing problems and financially stabilize the company are ongoing. If successful, Red Lobster might yet swim through these stormy waters and emerge stronger and more robust.

The story of Red Lobster’s current struggles serves as a tangible reminder of the delicate balance required to operate a large chain of restaurants. It also underscores the ripple effects that financial and managerial decisions can have across an entire operation, affecting everything from the bottom line to employee livelihoods.

So, next time you hear about a beloved restaurant facing closure, you’ll have a deeper understanding of the complex factors at play. If you’re a fan of Red Lobster, keep your fingers crossed and maybe plan a visit to your local branch to show your support—it might just help keep the doors open a little longer.

Thank you for joining us in breaking down this complex issue. Feel free to share your thoughts or any questions you might have on this subject. After all, the more we understand, the better we can support our favorite dining spots in times of need.