Hawaii, a tropical paradise known for its stunning beaches and vibrant culture, is a dream destination for many. But before you pack your bags and book your flight, it’s important to be aware of the cost of living in this picturesque state. With its remote location and limited resources, Hawaii can be quite expensive when it comes to everyday necessities like groceries, housing, and transportation. In this article, we will explore the various factors that contribute to the high cost of living in Hawaii, providing travelers with valuable insights for planning their budget and ensuring an unforgettable experience in this enchanting island paradise.

Overview of Cost of Living in Hawaii

Hawaii is known for its breathtaking beaches, rich culture, and tropical climate. However, it’s no secret that living in paradise comes at a price. The cost of living in Hawaii is significantly higher than the national average due to various factors. This article aims to provide an in-depth look at the different aspects that contribute to the overall cost of living in Hawaii, such as housing, transportation, food and groceries, utilities, healthcare, taxes, education, and entertainment.

Factors Affecting Cost of Living

Several factors influence the high cost of living in Hawaii. Firstly, the state heavily relies on imports for most goods, which results in higher prices due to shipping costs. Additionally, the limited availability of land and high demand for housing contribute to inflated prices. The cost of labor in Hawaii is also substantially higher than the national average, impacting the overall cost of goods and services. Lastly, the state’s isolated location translates to higher transportation costs, as fuel prices tend to be higher than on the mainland.

Comparison with Other States

When comparing the cost of living in Hawaii with other states in the United States, it becomes apparent that Hawaii consistently ranks among the most expensive. Housing costs, in particular, are significantly higher than the national average, with the price of both rental properties and homes for purchase being noticeably steep. The overall cost of food and groceries is also higher, partly due to the reliance on imports. While some states may have higher healthcare expenses or taxes, the combination of all these factors in Hawaii makes it a challenging place to live if you’re on a tight budget.

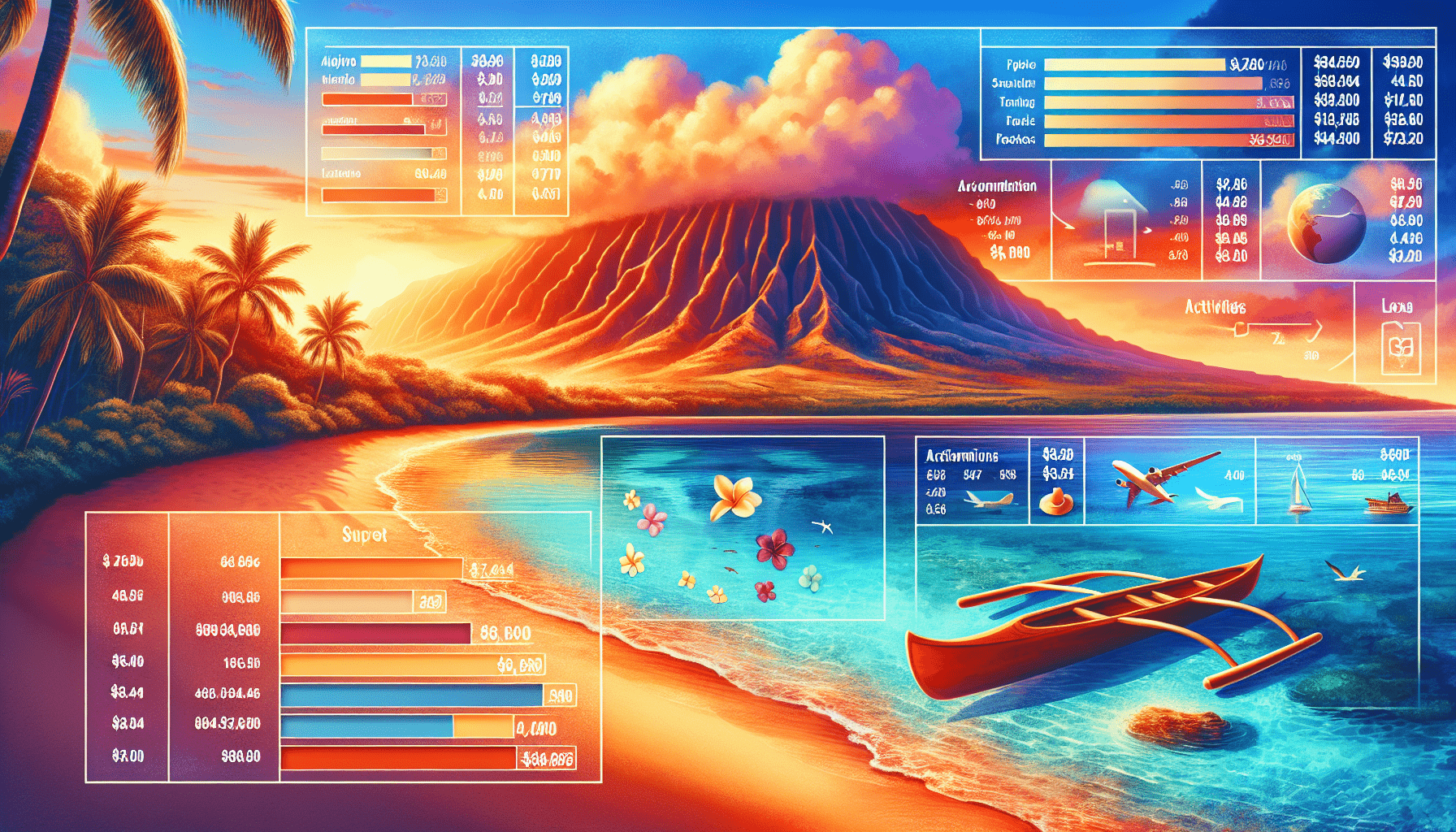

Average Cost of Living in Hawaii

Taking into account all of the factors mentioned above, it’s no surprise that the cost of living in Hawaii is considerably higher than the national average. The exact cost of living can vary depending on factors such as location within the state, family size, and lifestyle choices. However, as a general estimate, it is believed that living in Hawaii can be anywhere from 30% to 100% more expensive than living on the mainland. This disparity can greatly impact individuals and families, especially those with lower incomes or fixed budgets.

Housing

Housing costs in Hawaii constitute a significant portion of the overall cost of living. Whether you choose to purchase a home or rent, be prepared for higher prices compared to the national average.

Purchasing a Home in Hawaii

Owning a home in Hawaii can be a dream come true for many, but it comes at a premium. The limited land availability and high demand contribute to higher prices. The average price of a single-family home in Hawaii is significantly higher than the national average, often exceeding $1 million in popular areas such as Honolulu. It’s important to carefully consider your budget and explore various financing options before purchasing a home in Hawaii.

Renting a Home in Hawaii

Renting a home in Hawaii is another option for those who prefer flexibility or cannot afford to purchase a property. However, rental prices in Hawaii can also be quite steep. The average monthly rent for a one-bedroom apartment in Honolulu, for instance, can easily exceed $2,000. Rent prices tend to be lower in other parts of the state, but it’s important to research the specific area you’re interested in to get an accurate understanding of rental costs.

Average Housing Costs in Hawaii

To put the high housing costs in Hawaii into perspective, let’s take a closer look at some approximate average figures. The median home price in the state is around $700,000, while the average rent for a one-bedroom apartment is approximately $1,800 per month. Keep in mind that these figures can vary depending on the location within Hawaii, with more desirable areas commanding higher prices. It’s crucial to factor in housing costs when planning your budget for living in Hawaii.

Transportation

Transportation costs in Hawaii are another significant aspect of the overall cost of living. Owning a car may be a necessity for many residents, while others may rely on public transportation options.

Cost of Owning a Car in Hawaii

Owning a car in Hawaii can be more expensive than on the mainland due to higher fuel prices and the need for additional maintenance. Gasoline prices in Hawaii have historically been higher than the national average, which can impact your monthly transportation budget significantly. Additionally, the island geography and climate can lead to greater wear and tear on vehicles, resulting in increased repair and maintenance costs.

Public Transportation Options in Hawaii

For those who prefer to forgo car ownership or need an alternative mode of transportation, Hawaii does offer various public transportation options. The most popular option is TheBus, a reliable and affordable bus system that serves different areas within the islands. TheBus fares are relatively modest, with discounts available for students, seniors, and individuals with disabilities. Some areas, such as Honolulu, also have a rail system under development, which is expected to offer an additional means of public transportation in the near future.

Average Transportation Costs in Hawaii

While transportation costs can vary depending on your circumstances, it’s helpful to have a general idea of the average expenses in Hawaii. To give you a sense of the numbers, the average monthly cost of owning a car in Hawaii, including fuel, insurance, and maintenance, can range from $500 to $800. On the other hand, relying solely on public transportation can significantly reduce these costs, with monthly bus passes costing around $70 to $100, depending on the area you reside in.

Food and Groceries

When it comes to food and groceries, Hawaii’s unique geographical location and heavy reliance on imports contribute to higher prices. Whether you enjoy dining out or prefer to cook at home, it’s important to consider the impact on your budget.

Eating Out in Hawaii

With a diverse culinary scene and an abundance of fresh local ingredients, Hawaii offers a wide range of dining options. However, eating out regularly can quickly add up. Restaurants in popular tourist areas tend to have higher prices, while local eateries or food trucks can offer more affordable alternatives. It’s a good idea to explore various dining options and set a budget for eating out to ensure you keep your expenses in check.

Cost of Groceries in Hawaii

The cost of groceries in Hawaii is generally higher than on the mainland, primarily due to the need to import many food items. Fresh produce, in particular, can be more expensive, as it often needs to be shipped from other states or countries. However, purchasing local produce can sometimes offer more affordable options. Shopping at larger grocery chains or utilizing discount programs can help reduce costs to some extent, but it’s important to expect higher grocery bills compared to the national average.

Average Food Expenses in Hawaii

While individual food expenses can vary greatly depending on personal preferences and dietary choices, it’s possible to estimate average monthly food expenses in Hawaii. On average, a single person can expect to spend around $300 to $500 per month on groceries. Additionally, dining out can contribute an additional $200 to $400 per month, depending on how frequently you eat at restaurants. These figures can increase significantly for families or individuals who prefer to consume higher-priced items or dine at upscale establishments.

Utilities

Utilities include essential services such as electricity, water, internet, and cable. Understanding their costs can help you plan your budget effectively.

Electricity and Water Costs in Hawaii

Hawaii’s warm climate can lead to higher electricity bills, especially during the summer months when air conditioning is necessary. Additionally, the state aims to promote renewable energy sources, which can impact electricity costs. Water costs in Hawaii can also be higher due to the need to desalinate seawater or transport water to certain areas. It’s important to be mindful of your energy and water consumption to keep your utility bills within a reasonable range.

Internet and Cable Expenses in Hawaii

Internet and cable services in Hawaii are offered by various providers, with costs varying depending on the package and speed you choose. The average monthly cost for internet service can range from $40 to $100, while cable television packages can cost around $50 to $150 per month. Bundling services or opting for streaming platforms can offer more cost-effective alternatives to traditional cable packages.

Average Utility Bills in Hawaii

Determining the average utility bills in Hawaii can be challenging, as they depend on factors such as the size of your household, your energy usage, and the region you reside in. However, a rough estimate for a standard household of two individuals would be around $200 to $300 per month for electricity and water, and an additional $70 to $150 per month for internet and cable services. Keep in mind that utility bills can vary significantly, so it’s essential to monitor your usage and seek ways to conserve energy and water.

Healthcare

Access to healthcare and medical services is a crucial aspect of daily life, and it’s important to understand the costs associated with healthcare in Hawaii.

Health Insurance in Hawaii

Health insurance is a crucial component of accessing medical care in Hawaii. The state has a mandatory employer-sponsored health insurance program called the Hawaii Prepaid Health Care Act, which requires employers to provide health insurance coverage to their eligible employees. However, if you’re self-employed or not covered by an employer-sponsored plan, it’s essential to explore individual insurance options. The cost of health insurance can vary depending on factors such as age, coverage level, and deductibles.

Cost of Medical Services in Hawaii

The cost of medical services in Hawaii can vary depending on the type of care needed. Routine doctor visits or consultations typically have associated co-pays or fees, which can range from $20 to $50, depending on your insurance coverage. More specialized or intensive medical procedures can be significantly more expensive. It’s wise to budget for medical expenses and, if possible, maintain a health savings account to cover unexpected healthcare costs.

Average Healthcare Expenses in Hawaii

As healthcare costs are highly dependent on individual circumstances, it is challenging to provide an exact average for healthcare expenses in Hawaii. However, it’s recommended to budget around $200 to $300 per month for health insurance premiums. Additionally, considering other medical expenses such as co-pays, prescriptions, and other out-of-pocket costs, a general estimate would be around $400 to $600 per month. It’s important to carefully review your insurance coverage and factor in potential healthcare expenses when planning your budget.

Taxes

Taxes play a significant role in the overall cost of living, and it’s important to understand how they affect life in Hawaii.

Income Tax Rates in Hawaii

Hawaii has a progressive income tax system with multiple tax brackets. The highest income tax rate in the state is currently 11%, applying to those with incomes above a certain threshold. Lower-income individuals generally fall into lower tax brackets. It’s important to understand your individual tax obligations and factor them into your budget planning.

Sales Tax and Property Tax in Hawaii

Hawaii does not have a sales tax but instead imposes a general excise tax (GET) on the gross income of businesses. This GET is often factored into the prices of goods and services, indirectly affecting consumers. Additionally, property taxes in Hawaii can vary depending on the location and assessed value of the property. Homeowners should be prepared for annual property tax payments, which are generally higher than the national average.

Impact of Taxes on Cost of Living in Hawaii

The combined impact of income taxes, excise taxes, and property taxes on the cost of living in Hawaii can be significant. Depending on individual circumstances and income levels, taxes can considerably impact your disposable income and overall budget. It’s recommended to consult with a tax professional or utilize online tax calculators to estimate your tax obligations accurately.

Education

For those with children or those pursuing higher education, understanding the costs associated with education in Hawaii is essential.

Cost of Education in Hawaii

The cost of education in Hawaii can vary depending on the level of education and whether it is public or private. Public elementary and secondary education in Hawaii is generally free, as it is funded through taxes. However, there may be additional costs associated with school supplies, uniforms, and extracurricular activities. Private schools, on the other hand, can be more expensive, with tuition costs varying depending on the school’s reputation, location, and facilities.

Public and Private School Options

Hawaii offers a range of public schools, including elementary, middle, and high schools. These schools typically follow a standardized curriculum and are available to residents free of charge. Private schools, on the other hand, provide alternative educational options and often have smaller class sizes and specialized programs. However, private schools come with higher tuition costs.

Average Education Expenses in Hawaii

While public education is accessible to residents free of charge, there are still costs associated with school supplies, uniforms, and extracurricular activities. On average, parents in Hawaii can expect to spend around $500 to $1,000 per child per year on these additional education expenses. For those considering private education, tuition costs can range anywhere from $10,000 to $25,000 or more annually, depending on the chosen school and grade level.

Entertainment and Recreation

Living in Hawaii offers a myriad of entertainment and recreational activities due to its natural beauty and unique cultural experiences. Yet, it’s essential to consider the associated costs.

Cost of Entertainment in Hawaii

Entertainment options in Hawaii span a wide range of possibilities. From exploring stunning hiking trails and white sandy beaches to attending cultural festivals and live performances, the choices are abundant. However, some activities and attractions can come with a price tag. Popular tourist destinations, such as luaus or helicopter tours, can be relatively pricey. It’s important to consider your entertainment budget and explore free or low-cost alternatives, such as local community events or outdoor adventures.

Recreational Activities and Their Prices

Hawaii offers a multitude of recreational activities for outdoor enthusiasts. Surfing, snorkeling, hiking, and golfing are just a few examples of popular activities in the islands. While some activities, like hiking, are generally free, others may require equipment rental or admission fees. For instance, renting snorkeling gear or attending a golf session can vary in cost depending on the location and service provider. It’s recommended to research and compare prices to find the best deals on recreational activities.

Average Entertainment Expenses in Hawaii

Entertainment expenses can be highly variable depending on individual preferences and the frequency of participation. However, a monthly entertainment budget of $200 to $500 per person is a reasonable estimate for engaging in various recreational activities, attending events, or trying new experiences in Hawaii. Remember, exploring the natural wonders of the islands costs little to nothing and can provide endless enjoyment.

Tips for Reducing Cost of Living

Living in Hawaii certainly has its challenges when it comes to the cost of living. However, there are strategies you can employ to help reduce the financial burden.

Budgeting and Financial Planning

Creating a detailed budget and adhering to it can go a long way in managing your expenses effectively. Tracking your income and expenses, prioritizing your needs, and cutting back on unnecessary spending can help ensure you’re making the most of your resources. Explore budgeting apps or seek financial advice to optimize your budgeting and financial planning efforts.

Finding Affordable Housing Options

While housing costs may be high in Hawaii, there are alternatives to explore. Consider renting a smaller apartment, sharing housing expenses with roommates, or looking for housing options in less popular areas. Additionally, exploring government-subsidized housing programs or affordable housing initiatives can provide more affordable options for those in need.

Saving on Transportation and Food

Cutting transportation costs can be achieved by considering carpooling, utilizing public transportation, or even opting for alternative modes of transportation like bicycles. Taking advantage of employee or student discounted bus passes or carpooling programs can significantly reduce transportation expenses. For food costs, meal planning, purchasing local produce, and taking advantage of sales and coupons are useful strategies to save money on groceries. Limiting dining out to special occasions can also help keep food expenses in check.

Living in Hawaii can be a dream come true, but it requires careful financial planning and budgeting to make the most of your resources. By understanding the factors contributing to the high cost of living, exploring cost-saving strategies, and making thoughtful choices, you can navigate the expenses associated with paradise and enjoy all that Hawaii has to offer.