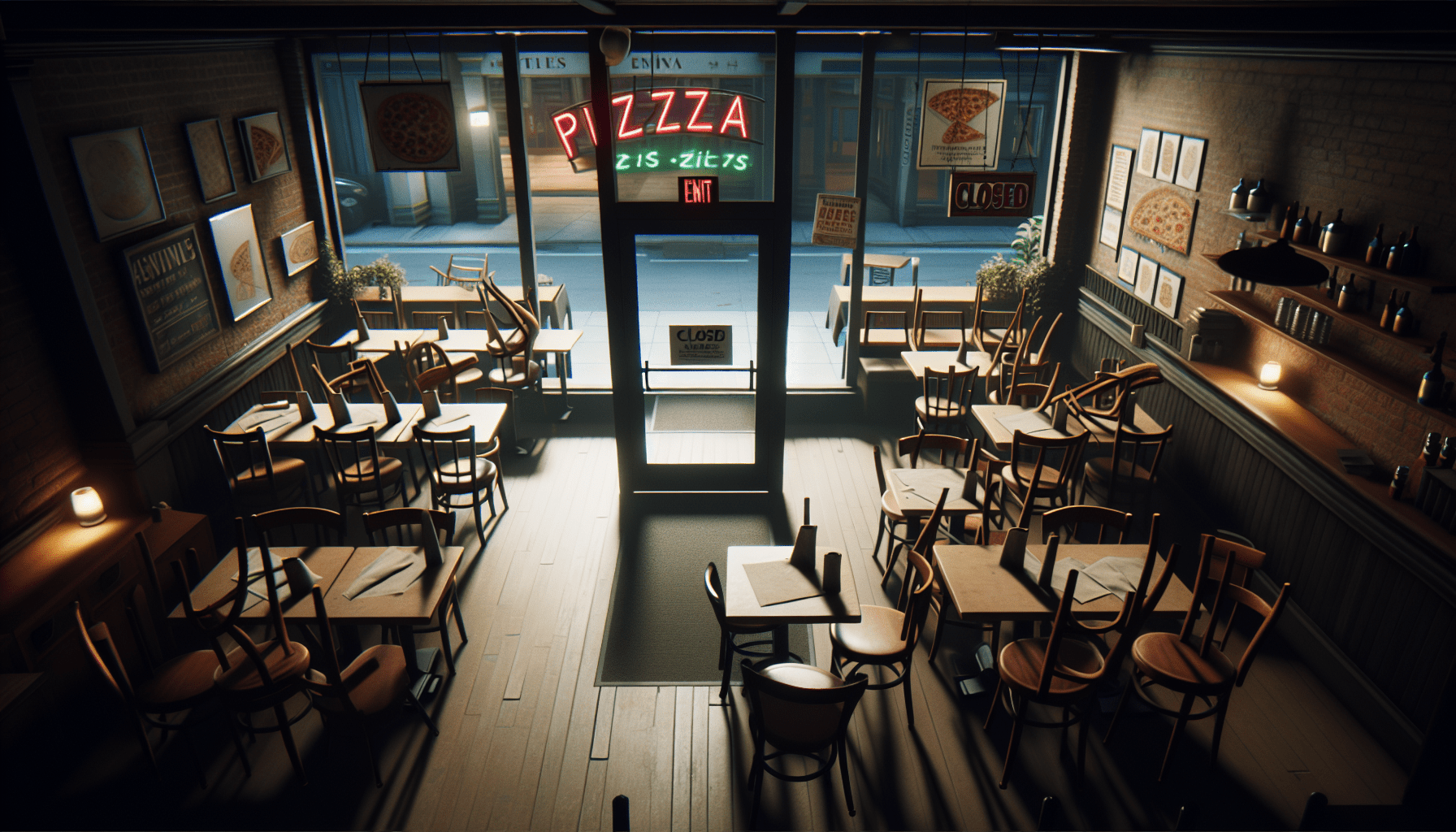

Have you ever wondered why so many pizza chain restaurants are filing for bankruptcy these days? The economy has been in considerable turmoil for the last few years, both nationally and globally. The lockdowns mandated due to the COVID-19 pandemic left many businesses struggling to tap into whatever capital they had to survive the uncertainty. While some businesses managed to weather the storm, an alarming number did not make it, and the aftershocks are still being felt. This situation, when combined with unusually high inflation, has created what many might call a “perfect storm,” pushing numerous pizza chains toward bankruptcy.

The rise in bankruptcy filings from pizza chains, once flourishing just a few years ago, can be attributed to various factors. These factors include over-leveraged balance sheets, lengthy shutdown periods that drastically impacted sales, and the rising cost of food and other necessary goods. It seems, however, that the worst may be behind us, though these economic forces have already done significant damage to many small businesses nationwide. Let’s take a closer look at three struggling pizza chains: Chuck E. Cheese, California Pizza Kitchen, and MOD Pizza.

Get an Official Zagat Restaurant Guide

The Economic Impact on Pizza Chains

It’s no secret that a challenging economic environment is harsh on the restaurant industry, and pizza chains are no exception. The extended lockdowns during the pandemic were especially cruel to these businesses, depriving them of crucial revenue streams. Furthermore, the impact of high inflation has caused operational costs, like the prices of food, rent, and labor, to skyrocket, further squeezing the already tight profit margins of these pizza chains.

The Consequences of Over-leveraged Balance Sheets

An over-leveraged balance sheet is one where a company has taken on more debt than it can reasonably manage with its revenue. For many pizza chains, this has been the unfortunate reality. They borrowed extensively to expand their reach, assuming steady, perhaps even rising, streams of income. However, when the pandemic threw a wrench into that plan, it became clear that servicing these debts would be much harder than anticipated. The situation is quite similar to the house of cards falling; once one revenue stream dries up, it brings down the financial stability of the entire operation.

The Pandemic’s Long Shadow

The lockdowns forced many pizza restaurants to rely heavily on takeout and delivery, often altering their long-standing business models to survive. In addition to the sudden pivot, most experienced a dramatic reduction in walk-in and dine-in customers. This period of diminished revenue hastened the need for many to seek bankruptcy protection to regroup and strategize a path forward—a path that often included closing several locations and laying off employees.

Rising Costs and Inflation

Food inflation has been a major concern post-pandemic, as it raises the cost of raw ingredients. Cheese, dough, toppings—all these essential components have increased in cost, making it more expensive to produce the same pizza. While restaurants have had to raise their menu prices to offset these costs, doing so presents the risk of alienating cost-sensitive customers who might choose to dine out less frequently or opt for cheaper alternatives.

Case Studies: Struggling Pizza Chains

Chuck E. Cheese: Surviving, But For How Much Longer?

Chuck E. Cheese filed for Chapter 11 bankruptcy in June 2020, mere months into the global lockdowns. The company’s financial position was untenable, with liquid assets evaporating fast. After a year of corporate restructuring, Chuck E. Cheese emerged in 2021 with a significant portion of its $700 million debt paid off and new leadership at the helm. The company began testing tiered membership programs in early 2024 to boost sales. However, these efforts have yet to show significant signs of success.

Rumors of Chuck E. Cheese working with Goldman Sachs to facilitate a potential sale, possibly to Dave & Busters Entertainment, reflect its precarious position. While still beloved as a children’s pizza party destination, its future remains uncertain.

California Pizza Kitchen: Climbing Back

California Pizza Kitchen followed a similar trajectory, filing for Chapter 11 bankruptcy in July 2020. This form of bankruptcy is aimed at financial reorganization rather than complete liquidation, which explains why these pizza chains are still operational. By November 2020, California Pizza Kitchen had successfully concluded its bankruptcy proceedings but not without significant hardship, including the closure of 31 locations.

In October 2022, a new CEO took the reins, guiding the company through lingering economic uncertainties post-pandemic. Despite progress, the challenge of food inflation continues to cast a shadow over the company’s recovery, suggesting that navigating these financial waters is far from straightforward.

MOD Pizza: A Different Approach

MOD Pizza has been rumored to be on the brink of bankruptcy after it shut down 26 locations in 2024. Instead of heading down the bankruptcy route, MOD Pizza opted for a different strategy by selling itself to Los Angeles-based Elite Restaurant Group. Whether this will save the brand is still uncertain, but it likely entails some restructuring in the coming months.

Just a few months prior, a new CEO was appointed in January 2024. While little is publicly known about the terms of the sale, store closures appear almost certain, indicating that significant changes are afoot.

Company Comparison

Here’s a table summarizing the critical information about these three pizza chains:

| Pizza Chain | Bankruptcy Filing | Restructuring/Recovery Efforts | Current Status |

|---|---|---|---|

| Chuck E. Cheese | June 2020 | Paid off $700 million debt, new leadership, testing tiered membership programs | Potential sale to Dave & Busters Entertainment |

| California Pizza Kitchen | July 2020 | Closed 31 locations, new CEO in October 2022, navigating economic uncertainty | Recovery ongoing, but food inflation remains a challenge |

| MOD Pizza | Not filed | Sold to Elite Restaurant Group instead of filing for bankruptcy, new CEO appointed in Jan 2024 | Facing uncertain future with likely store closures |

Get an Official Zagat Restaurant Guide

Why Are These Chains Specifically Affected?

While each pizza chain has unique circumstances, a few overarching themes contribute to their struggles.

High Operational Costs

Running a pizza chain involves numerous direct and indirect costs. From paying staff and maintaining the premises to sourcing ingredients and marketing, the expenses are considerable. Add to the mix higher costs for ingredients due to inflation, and the operating margin shrinks even further.

Intense Competition

The pizza industry is incredibly competitive, with countless local pizzerias, national chains, and delivery services vying for the same customers. This intense competition often forces businesses to engage in aggressive pricing strategies, further eroding profit margins.

Changing Consumer Preferences

As more people become health-conscious, the demand for traditional greasy pizzas has declined. While some chains have adapted by diversifying their menus to include healthier options, it takes time for these new offerings to gain traction. Additionally, this trend puts financial pressure on chains to constantly innovate and adapt.

Real Estate Challenges

Another often overlooked aspect is the significant real estate costs involved in maintaining multiple locations. Prime locations come with high rents, and the financial burden of holding these leases became even more pronounced during the lockdowns.

Strategies for Future Survival

Given the complex challenges these pizza chains face, what’s the way forward? Is there a viable strategy for these beloved brands to regain their former glory and thrive in an increasingly challenging economic climate?

Financial Restructuring

For many businesses, financial restructuring through Chapter 11 bankruptcy or other means appears to be a necessary evil. This legal provision allows companies to reorganize their finances, default on or renegotiate existing debts, and get a structured plan to repay what they owe without liquidating all assets.

Diversifying Revenue Streams

One way to tackle financial instability is by diversifying revenue streams. Chains could look into franchising, offering home-delivery meal kits, or even entering the frozen food market. The goal is to reduce dependency on in-store dining alone, thereby cushioning the blow from potential future disruptions.

Adapting to Consumer Trends

It’s crucial for these chains to be agile in the face of changing consumer preferences. Incorporating healthier menu options, plant-based alternatives, and even gluten-free choices can help attract a broader customer base. Some chains are already experimenting with ghost kitchens—a trend that gained popularity during the pandemic—allowing them to operate with lower overhead.

Leveraging Technology

Technology can offer significant advantages in terms of operational efficiency and customer engagement. Implementing comprehensive online ordering systems, mobile apps for loyalty programs, and improving delivery logistics can all contribute to a better customer experience and optimized operations.

Collaborations and Partnerships

Another way to improve fiscal health is through strategic partnerships and collaborations. This could be in the form of co-branding with other food products, or partnering with delivery services to widen their customer base. Prominent collaborations can help create buzz and attract new customers.

Conclusion: A Path Forward

The path ahead for struggling pizza chains is fraught with challenges but not devoid of hope. Economic turmoil, rising costs, and changing consumer behaviors have created a tough landscape, but there are avenues for recovery and growth. Chuck E. Cheese, California Pizza Kitchen, and MOD Pizza illustrate different approaches to tackling these hurdles, offering lessons in resilience and adaptability.

While it’s unclear what exactly the future holds for these chains, their efforts to innovate, restructure, and adapt offer a blueprint for navigating tough economic times. Whether through financial restructuring, embracing new consumer trends, or leveraging technology, these businesses are working diligently to find a path forward.

The question remains: Will these iconic pizza chains manage to turn things around? Only time will tell. However, their journey offers valuable insights for other businesses facing similar challenges, signaling that although the road to recovery may be long and winding, it is not impassable.

Get an Official Zagat Restaurant Guide